It is ironic that a Governor who is trying to increase Alaska’s competitiveness for oil investment dollars with the one hand is undermining it with the other. Yet, that is exactly what Governor Parnell is preparing to do in the coming legislative session.

It is ironic that a Governor who is trying to increase Alaska’s competitiveness for oil investment dollars with the one hand is undermining it with the other. Yet, that is exactly what Governor Parnell is preparing to do in the coming legislative session.

The Governor correctly has identified Alaska’s current oil tax structure as an impediment to attracting the investment dollars that Alaska needs to stabilize Alaska’s current oil production levels. Most anticipate that he will announce specific proposed reforms to address the problem sometime this coming week.

Yet at the same time, the Governor has announced that he will propose to the Legislature a budget which, adding the amount he has identified is available for “legislative priorities,” is the second largest proposed budget in Alaska’s history.

What does the size of the Alaska budget have to do with investment competitiveness? A great deal.

As we have written elsewhere on these pages, earlier this month the University of Alaska – Anchorage’s Institute of Social and Economic Research (ISER) published an FY 2014 update of its recent, annual series of reports on Alaska’s fiscal situation. The conclusions reached in the FY 2014 update are deeply concerning.

According to the report, “[r]ight now, the state [of Alaska] is on a path it can’t sustain. Growing spending and falling revenues are creating a widening fiscal gap. … Reasonable assumptions about potential new revenue sources suggest we do not have enough cash in reserves to avoid a severe fiscal crunch soon after 2023, and with that fiscal crisis will come an economic crash.”

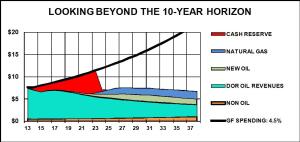

A slide from the report starkly summarizes the situation. The black line represents forecasted spending (at 4.5% annual growth), the blue and other lines building from the bottom forecasted revenues and the red the use of the Statutory and Constitutional Budget reserves to fund the difference between the two.

A slide from the report starkly summarizes the situation. The black line represents forecasted spending (at 4.5% annual growth), the blue and other lines building from the bottom forecasted revenues and the red the use of the Statutory and Constitutional Budget reserves to fund the difference between the two.

The red ends in FY 2023 because, at that point, both the Statutory and Constitutional Budget reserves are depleted. Because forecasted revenue no longer is sufficient to satisfy forecasted expenses, the slide leaves open what happens at that point.

Other slides contained in the ISER report plot various alternatives, such as instituting broad based income and sales taxes, and even using the Permanent Fund in the same way as the Statutory and Constitutional Budget Reserves, as a source of stopgap funding to match cash to expenses.

Most of the alternatives delay “judgment day” by various periods, but the end is always the same. The reserve funds ultimately run out and state spending inevitably crashes down to the level of whatever annual revenues remain.

But, as Senator Stedman said last year when I was attempting to make the point during a Senate Resources Committee hearing, “we” (the Legislature) won’t let that happen.

How will they prevent it? Two ways — one that Senator Stedman identified during our colloquy and the second that he didn’t.

The first is by cutting state spending before Alaska hits the fiscal cliff. But that, frankly, is only a way of easing into the cliff, rather than avoiding it. Instead of experiencing a precipitous cut in state spending all in one year, the state will gradually experience it over a number of years.

The end, however, is the same. At the end of the “fiscal slide,” state spending — and services — will be dramatically reduced.

The second way that the Alaska Legislature will deal with it — even if the Legislature is filled at the time by the oil industry’s staunchest supporters — is by raising taxes on the industry.

Having demonstrated the effect and set the precedent for doing so in 2007 in passing ACES, whatever Legislature is in place at the time the downturn starts again will resort to the tool as a way of putting off judgment day to another time, certainly until after the next election. The ISER report clearly puts the downturn beginning sometime in the early 2020’s, if not sooner.

That is why the Governor’s current budget undercuts oil investment. It leads directly to a situation within the next decade where the industry once again will be faced with increased oil taxes.

The consequences of this inevitability are significant. With oil tax reform alone, the industry may make investments for awhile that pay off in the short-term.

Without coupling oil reform with budget reform, however, the industry will continue to hold off on the larger set of investments that pay off primarily over the longer term because they will anticipate that, as with ACES, half way through the payout cycle — if not earlier — the state will raise oil taxes again and, from the investor’s perspective, confiscate the returns that otherwise justify the investment.

The future doesn’t have to be this way.

One of the alternatives discussed in the ISER report is the adoption of a “sustainable budget.” Under that approach, state spending is set at a level that can be maintained indefinitely into the future based on current savings levels and reasonable forecasts of future revenue streams.

Under that approach, current revenues that are in excess of the spending level — along with the current balances of the Statutory and Constitutional Budget Reserves — are set aside into an investment fund, or “nest egg” as ISER puts it. The earnings from that nest egg are then reinvested in the fund until such time as current revenues fall below the sustainable budget level. At that point, the necessary portion of the earnings stream from the nest egg is redirected to support state spending.

Done right, the sustainable budget approach operates much the same as your or my retirement account. We put money into the account while we are working (i.e., the revenue is flowing), and then live off the earnings from the retirement account as our working earnings decline.

Investment advisers calculate for us the amount of current savings we need to maintain in order to achieve a set revenue stream at the time of our retirement. Calculated correctly, we can make our pre- and post-retirement revenue streams the same. That is what a sustainable budget does for the state.

If the state budget was calculated and established in that fashion, future Alaskans wouldn’t be facing a fiscal cliff — or even a fiscal slide — and potential investors in Alaska wouldn’t need to be concerned about future changes in tax policy. Instead, both Alaskans and investors in the state could be secure in the future of the state’s fiscal environment.

To do that, however, state spending needs to be reduced, in ISER’s words, “starting now.” According to the ISER report, instead of the $6.5 (and counting the amount set aside for “Legislative priorities,” $7.0) B in spending proposed by the Governor for this coming year, “Alaska’s state government can afford to spend [only] about $5.5 billion.”

Anything more is done at the expense both of passing on a “financial burden” to future Alaska generations in terms of state spending cuts, and, unfortunately, undercutting the Governor’s stated goal of increasing oil investment.

If Governor Parnell and the Legislature are serious about increasing long term oil investment, they need to bite the bullet and adopt the current reductions in state spending necessary to achieve a long-term, sustainable budget. They cannot achieve the first without the second.

That is the message that I delivered to the Alliance last week during Meet Alaska. The slide deck for that speech is available here.

Another way to curb spending is to finish the work of the state and create boroughs. Funding village councils who claim immunity when asked to account for the money is ludicrus. I know some village (family) councils are better than others but here in Iliamna we have the worst. Even though we live in the Lake and Peninsula Borough our boro recognizes the family council as our govt. and endows the council with our tax dollars. No open elections or open meetings. A boro service area has been suggested as a alternative to a second class city by the Local Boundary Commission but the boro will here none of it. Until accountability is achieved in rural Alaska a sustainable state budget is a pipe dream. Even with the Pebble mine tax we are doomed to failure.

LikeLike

We have politicians, not angels. As long as money is easily accessible, the Legislature and the Governor will spend. My modest suggestion is that the State take the billions that are in the bank and all too accessible and use that money to pay down the $10 billion plus in unfunded pension liabilities. That will provide the twin virtures of keeping the money from burning a hole in the Legislature’s pocket and reducing the State’s future obligation to fund pensions when oil revenues may be declining. Once these windfall funds are gone, the State will be forced to manage its budget more in keeping with expected revenue streams.

LikeLike

Pingback: Alaska Oil Policy| The Governor commits an unforced error … | Thoughts on Alaska Oil & Gas

Pingback: Alaska Fiscal Policy| Gaining traction on sustainable budgets … | Thoughts on Alaska Oil & Gas

Pingback: Alaska Fiscal Policy| Another data point … | Thoughts on Alaska Oil & Gas