A couple of weeks ago I started writing the Sunday Morning Note as a place to capture and make available data from the prior week and from time to time, a note or two if useful about things that arose during the week we may have missed, or are useful to capture again.

A couple of weeks ago I started writing the Sunday Morning Note as a place to capture and make available data from the prior week and from time to time, a note or two if useful about things that arose during the week we may have missed, or are useful to capture again.

In this week’s Note we substitute for the latter a comment about an Alaska legislative hearing of significance this upcoming week.

We start, as before, with this past week’s data:

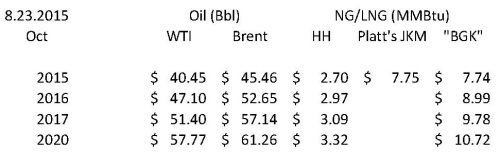

The source of the data is explained further here. Basically, the oil numbers are the Friday settle price, as reported on the CME Group website for the indicated month (in this case, September) for West Texas Intermediate (WTI) and Brent for the immediate, one-year, two-year and five-years forward.

The natural gas/LNG data is the same, from the same website, for Henry Hub and Platt’s “Japan Korea Marker” for the relevant month. As explained further on the reference page, “BGK” is an attempt to report a global crude oil price on an MMBtu basis as a very rough measure of the “Japan Customs-cleared Crude,” or what sometimes is referred to as the “Japan Crude Cocktail” (JCC), which is used with some lag as a starting point for most Japanese (and elsewhere in the Asian Pacific region) LNG purchase contracts.

The reason that I originally started several years ago looking at this data on a weekly basis was to separate near term price movements from longer term trends.

Often, near term price movements tell one story, while longer term trends tell another. Near term price movements tend to be driven by the news of the day, such as weather, currency fluctuations, market down- or up-ticks, or geopolitical disruptions. Longer term trends, on the other hand, tend to be driven by more fundamental market forces, largely what market makers anticipate will be moving supply, demand and the cost to produce 2, 5 and a longer period of years out when the trades mature and the cost/price of their current futures bets compete in the then-year market.

While news and other political analysts tend to focus on the near price, producers, their financiers and other investors tend to focus on the longer term price when weighing commitments of significant investment dollars.

I provide the above as context for hi-lighting that this past week not only did the near term price drop — the settle price for the week dropped from $42.50 to $40.45 (4.8%) for WTI, and from $49.22 to $45.46 (7.6%) for Brent — but more significantly, all 4 of the longer term oil prices I regularly track also shifted downward by more than 5%. 2017 WTI dropped on the week from $55.97 to $51.40 (8.2%); for the same period, Brent dropped from $61.22 to $57.14 ( 6.7%). 2020 WTI dropped on the week from $63.50 to $57.77 (9.0%); for the same period, Brent dropped from $66.07 to $61.26 (7.3%).

The take away is that the market is saying the news this week not only indicates that near term prices are headed lower, but that longer term markets are fundamentally shifting as well, with the expectation now that “lower, longer” will extend into at least the early 2020’s.

This coming week House Finance is holding a hearing on Alaska’s Fiscal Situation & Economic Analysis. The hearing is being held tomorrow (Monday) in the Anchorage LIO at 10:30a. The purpose of the hearing appears to be focused almost entirely on taking testimony from the Administration. The notice and materials are available here.

As I have explained previously on these pages, the economic model the Administration unveiled at its June Fairbanks conference and has been using since contains significant limitations that have the effect of making the state’s long term fiscal situation appear much more dire than it may be. See The (much) better economic model for #AKFuture … (June 2015).

The Administration’s model is capable of replicating a reasonably accurate picture of the state’s economic situation one and possibly two years out. Largely because of its inability to vary oil prices and production levels, however, in my view the model significantly misstates the state’s longer term revenue situation.

The effect is significantly to overdramatize the nature of the state’s fiscal situation over the longer term, which tends to make those using it believe the state needs a greater supplemental revenue stream — or deeper spending cuts — than likely is the case.

At least the model the Administration has used thus far also fails to measure the potential impact on the state’s private sector which would result from various tax or other options designed to transfer money from the private to the government sector. Without that, the Administration — and those who use the model — are flying blind about the effect of any such options on the overall Alaska economy. All that they know is that a given approach produces higher levels of government revenue; they do not know, however, if that comes at the expense of a reduced Alaska economy overall.

Those impacts can be significant. In a 2010 discussion of the effects of the Permanent Fund Dividend on the state’s private economy, for example, Dr. Scott Goldsmith of the University of Alaska-Anchorage Institute of Social and Economic Research (“ISER”) said this:

The most likely alternative use of the PFD [had dividends not been paid] would probably have been to increase capital spending by state government. There has always been a group interested in using the Permanent Fund principal to make loans for physical infrastructure construction, and proposals to spend general fund revenues on capital projects are always greeted more favorably that those that increase the state operating budget. If the money appropriated for dividends had instead gone to capital projects, economic activity would have been generated, just as has been the case with the dividend; but both the macro- and microeconomic effects would have been different. Capital spending would have generated less employment and increased income inequality.

Just as in oil markets, it is important to know and be able to separate short from long run economics. Without understanding both, those making what seem are good short term decisions may find they have substantially adverse long term consequences.

Hopefully Monday’s hearing will be only the start of the legislature’s evaluation of a broad range of data and options.

As I noted in my earlier commentary on the subject, there already is a better model available to help think through the state’s true long term fiscal picture. There likely also are those who have a more thorough understanding of the effects on the overall state economy of diverting money from the private to the government sector.

The state will be well served by the legislature hearing also from those other voices, sooner rather than later.

Dont know if you have access to bloomberg, but Bloomberg commodity index hit new low. 1999 level …a 15 year low. Oil is not the only thing falling. Deflation will be the next word from Wall Street. Deflation fears could take oil into mid 30”s . Its not the move to this level based upon history but how long we stay there. Venizuala cannot survive here and shoud be the first big fail or civil war. That may change the tide of oil. As yo u know that have the 2nd or 3rd largest reserves, but under produce. Inflation over 80% their which leads to civil unrest. Central banks are defenseless against deflation…it has to run its course, which is not for emerging markets….

LikeLike

Misspell on Venezuela

LikeLike

Pingback: Sunday Morning Note (Aug 30, 2015) … | Thoughts on Alaska Oil & Gas