Shortly after the start of the current Legislative session, Senator Lesil McGuire introduced Senate Concurrent Resolution 4, which would establish an “Alaska Oil and Gas Competitiveness Review Task Force.” If adopted — as it should be — the resolution has the potential to become one of the most significant pieces of long-term legislation passed this session.

The resolution has been mischaracterized by some. For example, when introduced one of the Anchorage media outlets characterized the resolution as “another potential delay for Governor Parnell’s proposal to ease the tax burden on the oil industry.”

The concern appears to be that the review proposed by the resolution could be used as an excuse to delay action on various bills recently introduced by the governor and others to modify ACES — the Palin-era oil tax that many believe is seriously undermining near term oil investment in Alaska.

Such concerns seriously miss the point of Sen. McGuire’s resolution, however. By its own terms, the proposed review is intended to focus on “long-term investment in and development of the state’s oil and gas resources.” It proposes exactly the type of review that Alaska needs to undertake.

Why is that different than what the governor and others are proposing?

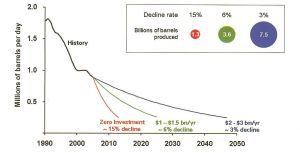

One chart tells the story.

Submitted by BP as part of its legislative testimony (.pdf) in 2006, the chart begins by showing the actual history of Alaska production from 1990 through 2005. From there, the chart projects three potential futures for Alaska production.

The futures differ by the levels of investment made in the continued development of North Slope oil. As oil fields evolve, continued levels of investment are required in order to maintain production.

The first potential future (in red) assumes no investment in the continued development of the existing North Slope fields. The result is that the fields continue to produce for a few years at an increasingly steep decline curve. Under that scenario, sometime around 2015 North Slope production reaches the point at which TAPS no longer operates.

The second potential future (in green) assumes a continuation of the then current (2005 – 2006) levels of investment in the development of North Slope fields, in the range of $1 billion to $1.5 billion per year. As the testimony explains, “History tells us that the decline will be around six percent per year,” with the end of production sometime in the 2020’s.

The third potential future (in blue) is the most significant — “The Prize.”

As projected in the testimony, at sustained, long-term, average investment levels of roughly double those then being made, annual production declines could be cut roughly in half, production from existing state lands extended to roughly 2050 and, most importantly, nearly an additional 4 billion barrels of oil recovered over the remaining life of the fields.

At an average real wellhead value of $75/barrel (in 2011 dollars), that additional recovery would produce an additional $300 billion in value over the remaining life of the fields. At 20 percent — just to pick a figure — the state’s share of that additional value would be around $60 billion.

How does the chart differentiate Sen. McGuire’s approach from the recent bills introduced by the governor and others addressing ACES?

Senator McGuire’s proposed competitiveness review largely is focused on developing changes to the state’s fiscal regime that are necessary to increase long-term investment to the levels necessary to achieve the “Prize.” The bills recently introduced by the governor and others, instead, are more focused on the immediate problem created by ACES.

It is important to address both. Due to the investment disincentives created by ACES, Alaska’s production is beginning to decline even more rapidly than the 6 percent “historic” rate discussed in the 2006 testimony. As reported earlier this year, oil production in Alaska fell 7 percent in 2010 and some are concerned that, absent restoring a favorable investment climate, the rate will continue to increase in coming years.

In other words, Alaska increasingly is trending toward the most bleak of the possible futures.

The bills proposed by the governor and others address those concerns in various ways. For example, House Bill 17, introduced by Speaker Chenault and Representatives Hawker, Johnson and Olson reduces the beginning rate under ACES from 25 percent to 20 percent and changes the rate and manner at which the tax escalates in order to reduce the level of government take at higher oil prices.

The governor’s bill (.pdf) takes a similar approach, but also revises and expands tax credits for certain types of expenditures and establishes a different, lower rate for oil and gas produced in the future from areas outside of existing “units” not currently under development. Senator Wagner’s Senate Bill 85 similarly provides incentives for oil and gas produced from new areas.

While no doubt helpful in redirecting Alaska back toward the 6 percent, “historic” decline rate, these bills do not significantly move Alaska onward toward the “Prize” suggested by the 2006 testimony.

There are several reasons why they do not have that effect.

First, even at the reduced levels of government take proposed by the various bills, the resulting tax rates remain significantly higher than the Alaska’s historic rate and much too high to attract the levels of sustained investment necessary to realize the “Prize” of the third potential future.

A substantial share of the resource to be captured by the “Prize” is heavy, viscous and other challenged oil. While the resource is well identified, capturing and producing these types of resources in an Arctic environment will require the development and implementation of significant new technologies. Such efforts are expensive, and because they involve “cutting edge” technology, entail substantial risk.

Today, other places in the world offer much better terms for such “cutting edge” investments. In order to redirect that investment to Alaska, Alaska’s level of government take needs to return toward historic levels, which was critical in the first place to the development of Prudhoe and the other North Slope fields.

Second, in order to attract the level of sustained, long-term investment necessary to achieve the “Prize,” Alaska’s fiscal system must be durable — in other words, reliable — over the long term.

In developing new sources of production, a significant part of the investment is made up front, before production begins. Producers will not make the increased level of investments required to achieve the third future if they don’t have a good understanding from the outset of what the level of government take is going to be 5, 10 and 15 years out, as production begins, reaches its peak and then (hopefully) goes on plateau for an extended period.

While the recent bills propose to reduce the current level of government take, none of them address the need for long-term durability. The tax rates adopted in the bills easily can be changed back to higher levels in coming years. In exchange for long-term producer investment, the State must be prepared to commit similarly to a long-term, reliable fiscal structure.

Third, some of the proposals, particularly including the governor’s and Sen. Wagner’s, rely heavily on exploration and early development related tax credits to achieve reductions in the overall rate of government take. In the oil industry, such tax credits can be useful in spurring near term, relatively low level investments. For example, producers deciding whether to drill a given set of wells or make other investments with a relatively short term time horizon may be influenced by the availability of credits.

Such credits seldom motivate substantial long term production investments. The reason is that is that they are largely focused on spurring the types of investment made up front, before high levels of production begins. While such investment tax credits may lower the overall tax burden during the early years of field development, they do not have much effect in later years, once production begins.

If the effective tax rates that again become applicable in the later years, once investment declines and production increases, are not competitive with those applicable to alternative investments over the same, long term timeframe, producers will not make those upfront investments at the outset.

Alaska has the potential to play a significant, continuing role in the global oil and gas industry. As BP’s 2006 testimony explains, by some measures the North Slope still holds roughly as much known oil and gas resource as has been produced since the beginning of Prudhoe Bay. Just last year, Forbes listed Alaska as one of “The Top 10 Oil Fields of the Future.”

Because of the challenging nature of the resource, however, to achieve that “Prize” Alaska must do things differently as it approaches the future than it has in the past. While many think that they have an idea of what is required, Alaskans need to develop a comprehensive understanding of the governmental policies that are necessary to deliver on that long-term promise.

Senator McGuire’s resolution is a well thought out and meaningful response to that need. A review of what is necessary to attract long term investment on the level necessary to achieve Alaska’s Prize is an important effort. Hopefully, the Legislature will share in the vision and adopt Sen. McGuire’s resolution in the very near future.

Reprinted from Alaska Dispatch, Commentary (Feb. 10, 2011) (http://www.alaskadispatch.com/voices/tundra-talk/8712-alaskas-future-sen-mcguires-proposed-competitiveness-review-is-important).

That does not explain why BP has let its infrastructure deterioriate to the point of yearly costly interruptions in production.

I agree that Alaska should rethink its tax policy. However, you need to realize that Alaska is gov’t, not a large private sector industrial base like Alberta that generates revenue streams from petrochemicals as well as oil/gas exploration and development.

What the Legislature should be doing is providing for incentives to increase value added resource development of our hydrocarbon resources rather than maximizing the return for just the State coffers.

McGuire’s study is a delay and is unnecessary. The issue has been studied to death. Just more CYA and no leadership.

In the mean time, Alaska’s window of opportunity is closing for a competitive NG pipeline to Valdez.

The closing of the LNG plant was the last knock on the door before the collapse of south central’s gas production.

McGuire and the rest of her ilk have delayed, obfuscated, and otherwise done nothing to incentivize to encourage further development in Cook Inlet. Now, it is too late.

Alaska will import natural gas.

LikeLike

Pingback: Alaska’s Future| Focusing on the end result | Thoughts on Alaska Oil & Gas

Pingback: The most important slide in this election … and why I have contributed to Mike Dunleavy and Jeff Landfield | Thoughts on Alaska Oil & Gas

Pingback: Alaska Fiscal & Oil Policy| Now the really hard work begins … | Thoughts on Alaska Oil & Gas

Pingback: Alaska Oil Policy| SB 21′s “Oil & Gas Competitiveness Review Board” needs a fix … | Thoughts on Alaska Oil & Gas

Pingback: The one “must have” of oil tax reform … and its not in the bill now | Thoughts on Alaska Oil & Gas